Start Date:

06 August, 2025.

End Date:

08 August, 2025.

Course Overview

Complete overview of the capital market: aiming at a general understanding of market mechanics and of financial instruments characteristics.

Classes feature tests and practical applications using MS Excel.

Course Objectives

To equip capital market operators with a general skill required for success in this volatile market

Course Outline

- Market players: financial intermediaries, market infrastructures

Transactions value chain: Front Office, Middle Office, Back Office

Distinction between regulated and over-the-counter exchanges

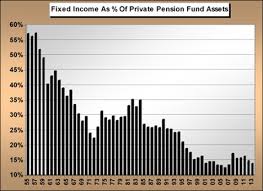

Distinction between cash products and derivatives - Arithmetic return rate and Compound Annual Growth Rate (CAGR)

Discount rate and risk premium

Valuation bases of financial products: intrinsic value and discounted value - Central bank and monetary policy

Guaranteed transactions and blank transactions

Cash products: bank certificates, government bonds - Characteristics of bonds

Primary market and secondary market

Valuation of a zero-coupon bond

Rating and bond spread

Interest rate derivatives - Spot trading

Forward trading

Foreign exchange options (FX Options) market

Speculations and hedging - Organization: compartments, regulates markets / electronic trading platforms

Fundamental analysis of a stock valuation: beta and risk premium notions Technical and chartist analyses of a specific stock performance