Start Date:

19 August, 2024.

End Date:

21 August, 2024.

Course Overview

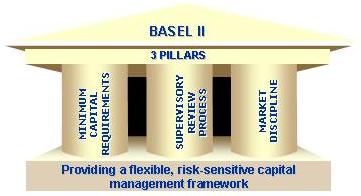

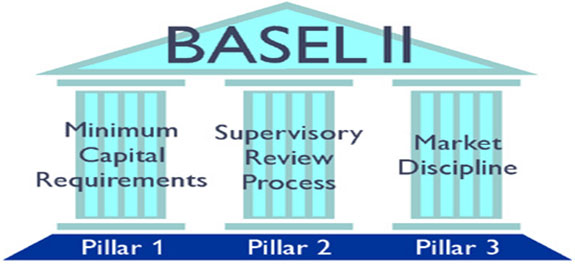

This training covers the operational risk management techniques according to the Basel II framework.

Course Objectives

To equip participants with the required skill to operate successfully in this department

Course Outline

Presentation of the Basel II general framework and capital requirements

- Historical context: Basel I, the Cooke ratio and its limitations

- Quantitative requirements: McDonough ratio, Basel II first pillar

- Qualitative requirements: second pillar and third pillar

- Implementation of the Basel II accord in the European Union

- Equity capital components: Tier 1, Tier 2, Tier 3

Operational risk - definition, sources, basic approach

- Definition and sources of operational risk

- Classification of loss-generating events

- Basel II committee recommendations regarding operational risk

- Basic market indicator approach: the alpha factor

- Standardized and alternative (ASA) approaches : standard betas

Case study : Assessment of equity capital requirements covering operational risk in a universal bank using the standardized approach

Operational risk - Advanced Measurement Approach (AMA)

- Estimating unexpected losses : historical data (internal and external), scenarios ( stress tests and Monte Carlo simulation)

- Factoring in the operational environment and internal controls (qualitative criteria)

- Implementation of risk-reduction techniques (insurances)

Implementation of a Business Continuity Plan (BCP)

- Basel II committee principles governing Business Continuity Planning in the event of a major risk

- Practical steps for the implementation of a Business Continuity Plan within a major bank