Start Date:

24 September, 2025.

End Date:

26 September, 2025.

Course Overview

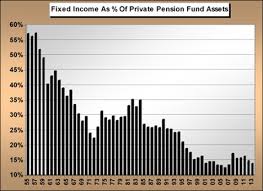

Hands-on training covering all the aspects of the management of a fixed rate bond portfolio (active strategies and immunization strategy) Prior basic knowledge of interest rate products is recommended.

Course Objective

To prepare participants with the necessary skill to function in this department

Course Outline

Fundamentals of bond valuation

- Bond characteristics : maturity, internal rate of return, duration, convexity

- Determination of bond portfolio characteristics

- Theoretical explanations of the interest rate term structure

Index-based active portfolio management strategies

- Statistical analysis of the yield curve : Nelson-Siegel model

- Economic analysis of the yield curve : bear/bull flattening, bear/bull steepening

- Introduction to several active strategies : bullet, barbell, ladder

Immunization strategies of a bond portfolio

- - Theoretical bases of immunization : acquired value and duration

- Single period immunization and multiple period immunization

- Conditional immunization and hybrid strategies

Diversification of a portfolio using derivatives

- Hedging using swaps or futures

- Hedging using vanilla options (cap, floor, collar)

- Hedging using synthetic products (swaptions, variance swaps)