Start Date:

19 May, 2025.

End Date:

21 May, 2025.

Course Overview

This course covers the Basel II credit risk management techniques: standardized approach and advanced approach (internal ratings).

This training requires prior knowledge of basic statistics and financial mathematics notions.

Course Objective

Participants shall be exposed to hands-on- deck treatment of various approaches to Basel II Credit Risk Management Techniques

Course Outline

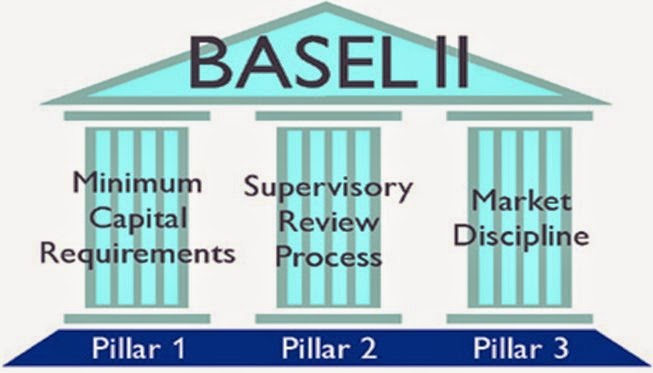

Presentation of the Basel II general framework and capital requirements

- Historical context: the Cooke ratio and its limitations

- Quantitative requirements: McDonough ratio, Basel II first pillar

- Qualitative requirements: second pillar and third pillar

- Implementation of the Basel II accord in the European Union

- Equity capital components : Tier 1, Tier 2, Tier 3

Implementation of the credit risk assessment standardized approach

- General introduction to the credit risk assessment standardized approach

- Resorting to external ratings and pondering counterparts

- Calibration of the Basel parameters according to the selected options

Internal ratings models (advanced approach)

- Determination of the model parameters: Probability of Default (PD) and Loss Given Default (LGD)

- Determination of the Exposure At Default (EAD) : asset/liability outflow laws

- Management of a credit portfolio : correlations and transition matrix

Application : review of Moody's KMV and J.P. Morgan's Credit Metrics internal ratings

Implementing the advanced approach models: strategy and organization

- Risk rating system governance: minimum requirements, risk quantification, validation of internal estimates

- Quality controls and financial communication requirements

Application: implementation of the "advanced approach" models (strategy, organization and information systems)

Management of credit guarantees and derivatives

- Management of the guarantees using standardized approach and advanced approach

- Credit derivatives: accounting and prudential aspects

- Credit risk enhancement techniques

Prudential management of securitization

- Operational requirements on classic securitizations and synthetic securitizations

- Management of securitization exposure: standardized approach

- Impact of the financial crisis on prudential requirements