Start Date:

03 September, 2025.

End Date:

05 September, 2025.

Course Overview

Banking business and indeed most corporate endeavors are loaded with risks and uncertainty. The ability to navigate through this volatile terrain is a function of training and experience. This is the course for core finance practitioners in banks, insurance, discount houses, corporate treasury, government treasury functions, stock broking houses, asset management companies, financial regulators etc.

Course Objectives

At the end of this training, participants would have become very conversant with many type of risk prevalent in their business and how to conveniently handle such risk and even profit from such risks

Course Outline

Risk Management vs. Risk Measurement

What Are Risk Management and Risk Measurement

Systemic vs. Idiosyncratic Risk

Risk, Uncertainty, Probability

What Is Risk

Risk Measures

Randomness and the “Illusion of Certainty”

Probability and Statistics

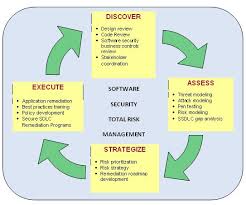

Managing Risk

What Is Risk Management

Manage People

Manage Process

Manage Technology, Infrastructure, and Data

Understand the Business

Organizational Structure

Overview of Regulatory Issues

Managing the Unanticipated

Strategy

Financial Risk Events

Systemic vs. Idiosyncratic Risk

Systemic Financial Events

Measuring Risk

What Is Risk Measurement

Typology of Financial Risks

Introduction to Quantitative Risk Measurement

Methods for Estimating Volatility and VaR

Analyzing Risk

Risk Reporting

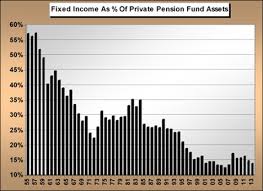

Credit Risk

Risk Measurement Limitations