Start Date:

10 September, 2025.

End Date:

12 September, 2025.

This training course covers all the aspects of the management of a long only equity portfolio from benchmark selection to risk assessment and performance evaluation, including the equity selection phase (through stock picking or data mining)

Learning Objective:

At the end of this session, participants will be able to:

- Define portfolio management and bench marking;

- Select and construct portfolios of investment;

- Diversify risks;

- Evaluate portfolio performance

Course Outline

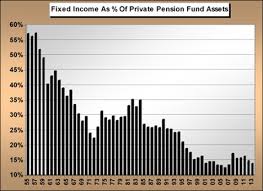

- Portfolio management theory

- The Markowitz model and mean-variance analysis

- Capital Asset Pricing Theory (CAPT)

- Multiple factor analysis and the BARRA model

- Industry diversification and geographical diversification

- Definition of a management style and benchmark selection

- Management style: value versus growth, large cap versus small cap, etc.

- Introduction to the Fidelity and Morning Star matrices

- Benchmark selection : characteristics of a good benchmark

- Equity selection : filtering through statistics, financial analysis, and conviction

- Definition and follow-up of the tracking error

- Analyzing the risk factor of an equity portfolio

- Assessment of the Value At Risk (VaR) of an equity portfolio

- Risk indicators : Sharpe ratio, Treynor ratio, Jensen's (alpha) evaluation

- Hedging strategies : forex risk, market risk

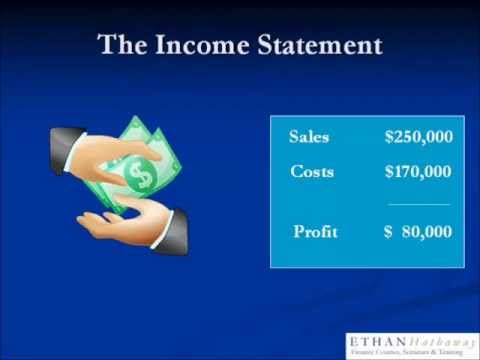

- Performance attribution and GIPS format reporting

- Fama evaluations: selectivity, diversification

- Performance attribution: selection effect and allocation effect, market timing

- Performance reporting : introduction to the GIPS standards