Start Date:

14 July, 2025.

End Date:

16 July, 2025.

Course Overview

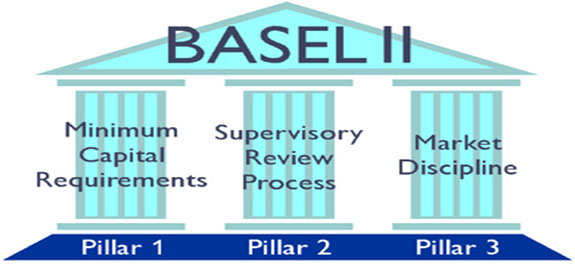

Sometimes there are issues between accounting personnel saddled with the task of handling VAT and With-holding tax and Tax Office. These conflicts impede cordial relationship expected of two stakeholders in the tax field and by extension affect the tax affairs of the employers.

Course Objective

Participants would learn how to handle VAT matters and With-holding tax issues in a more friendly and efficient manner.

Course Outline

-

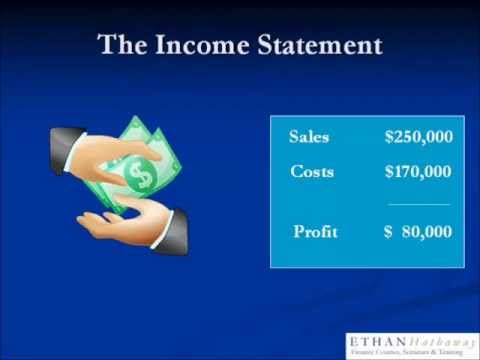

Inward VAT accounting

-

Outward VAT accounting

-

Rendition of VAT

-

Treatment of queries and complaints

-

Compilation of both ends of the With-holding tax

-

Application of the net with-holding tax

-

Accounting treatment of VAT and With-holding tax