Start Date:

21 August, 2024.

End Date:

23 August, 2024.

Course Overview

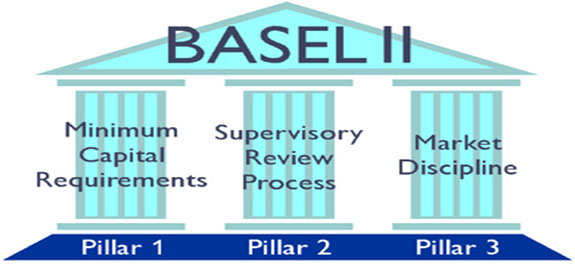

This course aims to introduce the general structure of the Basel II prudential ratio as well as the quantitative - credit risk, market risk, operational risk - and qualitative - internal controls, market discipline - requirements linked to the three pillars of the Basel II framework.

Course Objectives

To improve finance personnel with the general requirements and operations of the Basel II framework and prudential scheme

Course Outline

Presentation of the Basel II general framework

- Basel II committee history: the Cooke ratio and its limitations

- Quantitative requirements: McDonough ratio, Basel II first pillar

- Qualitative requirements: second pillar (internal controls) and third pillar (market discipline)

- Implementation of Basel II in the European Union and in other world countries

First pillar / Credit risk - Standardized approach and advanced approach

- Standardized approach to credit risk

- Advanced approach: "foundation" and "advanced" internal ratings

- Main differences between the three methods

- Implications for organization and information systems

- Discussed points will be illustrated with concrete examples and practical applications

Market risk, operational risk

- Market risk: simplified approach and standardized approach (VaR, internal rating models)

- Operational risk: basic indicator, standardized approach and Advanced Measurement Approach (AMA)

- Implications for organization and information systems

Applications :

- assessment of the market risk on an equity portfolio

- management of operational risk caused by a system malfunction

Second pillar / Internal controls and third pillar / market discipline

- Internal controls in Basel II: compliance, risk management

- Information and financial communications transparency (third pillar)

- Connecting Basel II requirements and IFRS standards