Start Date:

14 September, 2022.

End Date:

16 September, 2022.

Course Overview

This training course covers all the aspects of the management of a long only equity portfolio from benchmark selection to risk assessment and performance evaluation, including the equity selection phase (through stock picking or data mining) .

Course Objectives

To equip participants with the necessary skills to succeed in this department

Course Outline

Portfolio management theory

- The Markowitz model and mean-variance analysis

- Capital Asset Pricing Theory (CAPT)

- Multiple factor analysis and the BARRA model

- Industry diversification and geographical diversification

Definition of a management style and benchmark selection

- Management style : value versus growth, large cap versus small cap, etc.

- Introduction to the Fidelity and Morning Star matrices

- Benchmark selection : characteristics of a good benchmark

- Equity selection : filtering through statistics, financial analysis, and conviction

- Definition and follow-up of the tracking error

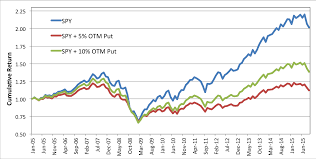

Analyzing the risk factor of an equity portfolio

- Assessment of the Value At Risk (VaR) of an equity portfolio

- Risk indicators : Sharpe ratio, Treynor ratio, Jensen's (alpha) evaluation

- Hedging strategies : forex risk, market risk

Performance attribution and GIPS format reporting

- Fama evaluations: selectivity, diversification

- Performance attribution: selection effect and allocation effect, market timing

- Performance reporting : introduction to the GIPS standards