Start Date:

27 August, 2025.

End Date:

29 August, 2025.

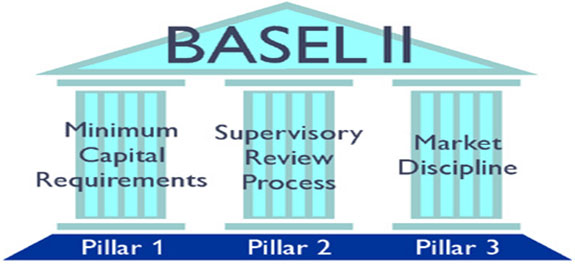

The Basel Committee on Banking Supervision has issued for a package of proposals to strengthen global capital and liquidity regulations with the goal of promoting a more resilient banking sector. The objective of the Basel Committee's reform package is to improve the banking sector's ability to absorb shocks arising from financial and economic stress, whatever the source, thus reducing the risk of spill over from the financial sector to the real economy. This training is compulsory for banking players to maintain their operational relevance in national and the global space.

This training requires an understanding of statistical notions, and financial mathematics, as well as a fair knowledge of the financial instruments mentioned in the course (underlying, options).

Learning Objectives:

At the end of this session, participants will be able to:

- Define the Basel II framework for national and global banking institutions;

- Assess the Value at Risk;

- Calculate all market risk ratios including interest rate risks demanded of Basel II;

- Calculate capital requirements of several products;

- Evaluate compliance of the Basel II requirements.

Course Outline

- General framework of market risk assessment

- Scope and implications of the capital requirements

- Asset valuation methodology : mark-to-market, mark-to-model

- Actions on counterpart risk within the trading book

- Introduction to the assessment methods : standardized approach, internal rating models

- VAR assessment: historical method, risk modelling, Monte Carlo simulation

- Application : Assessing the 99% VAR of a portfolio containing two assets using different methods

- Assessing the interest rate risk

- Specific risk: risk related to the issuer, hedging with credit derivatives

- General market risk: maturity/duration, advanced methods (Vacisek, Cox-Ingersoll)

- Risk related to interest rate derivatives : positions, forward contracts

- Applications: Calculating the capital requirements of several interest rate products

- Assessing equity risk

- Assessing specific risk and general risk

- Index-related risk and requirements affecting arbitrage

- Calculating the VaR of an equity portfolio using the BARRA model

- Applications: Calculating the capital requirements of an equity portfolio

- Assessing forex risk

- Assessing the position in a given currency

- Assessing positions in multiple currencies

- Procedures applicable to structural positions

- Applications: Calculating the capital requirements of several forex positions

- Assessing risk on basic products (commodities)

- Directional risk

- Long term asymmetry risk

- Basis risk

- Applications : calculating the capital requirements for several commodity futures portfolio

- Managing options related risk

- Delta plus approach: delta, gamma, vega

- Matrix analysis approach: variation intervals

- Advanced approaches: Black-Sholes, Crank-Nicolson, volatility surfaces