Start Date:

27 October, 2025.

End Date:

29 October, 2025.

This intensive 3-day training course in Risk Based Internal Auditing covers the main audit functions and the process of implementing an enterprise risk management approach (ERM) when conducting internal audits

The training program covers in great detail all steps involved in planning, developing and implementing a risk-based approach.

Course Objectives

Delegates would be able to:

- Undertake a Risk-based approach to internal auditing

- Evaluate Enterprise-Risk Management and effectively establish a framework in their organizations

- Assess Internal Audit readiness to adopt a risk based approach

- Develop a plan on how implement risk based internal auditing

Course Outline

- Why risk-based internal auditing?

- Risk-based internal auditing defined

- The paradigm shift in internal auditing: why it is happening and why it is necessary

- How risk-based auditing differs from current approaches

- The advantages of risk-based auditing to you and your organization

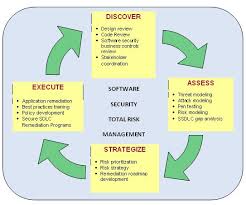

- Enterprise Risk Management

- Objectively driving the Enterprise Risk Management environment

- Equating risk management and corporate governance

- The primary subsets of enterprise risk management

- Strategically cascading risk ownership

- The impact of ERM on the internal audit group

- Fundamental issues of how risk will be assessed

- Risk registers

- Key attributes of a risk-based audit function

- Understanding the meaning of ‘true business risk’ and its impact on the audit function

- Effectively utilizing the three key components of real risk assessment

- Ability to identify key types of business risk

- Understanding how business risk should drive the audit function

- Acknowledging the interrelationship between business risk and control failure

- Making risk a top priority

- Evaluating Internal Audit’s readiness to adopt a risk-based approach

- Defining the skill sets and competencies required under a risk-based approach

- Strategies for educating your auditors in risk-based approaches

- Focusing on deliverables as the audit product

- Transitioning existing audit styles and defining new ones

- Identifying reporting relationships

- Redefining the audit process for a risk-based function

- Creating a plan for implementing risk-based auditing in the organization

- Creating a dynamic/fluid audit plan

- Targeting the engagement on key risk areas for focused, high-impact, resource maximization

- Employing risk-centric fieldwork tools and techniques

- Utilizing a business risk-oriented reporting format

- Measuring real value of the audit function in business terms using the most up-to-date audit tools