Start Date:

20 October, 2025.

End Date:

22 October, 2025.

Course Overview

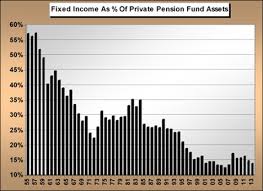

The global corporate and government bond markets have experienced a renewal of substantial rates of growth in issuance since the global financial crisis, the result of a variety of factors – increased government budget deficits and debt issuance post-credit crisis, and corporate bond issuance resulting from the need for balance sheet repair, low interest rate levels and the need to diversify funding sources in an environment of reduced bank loan origination capacity. Furthermore, investor appetite for bonds relative to equity investment has increased in the current volatile market environment.

Course Objectives

This 5-day program provides participants with a highly practical context to enhance their understanding of bonds, bond pricing, risks, yield curve modelling, with a particular focus on bond trading techniques and the day to day activities involved in fixed income trading and portfolio management.

Course Outline

Fixed income fundamentals – Pricing and Risk Characteristics

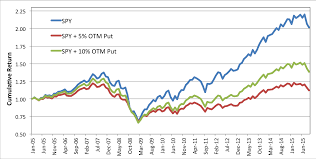

- Fixed Income Trading and Investment Strategies

- Yield Curve Modelling and Analysis

- Bond Portfolio Management – Strategic and Tactical Asset Allocation

- Fixed Income Active Management Strategies

- Portfolio Construction and Risk Budgeting

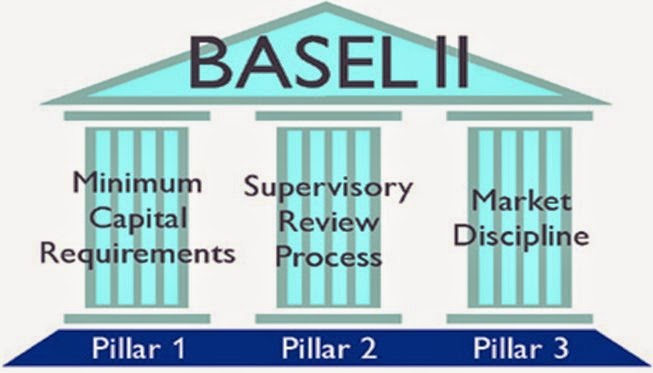

- Interest Rate, Inflation and Credit Derivatives

- Applications of Derivatives in Fixed Income Portfolio Management

- Bond Portfolio Management – Real-time Trading Simulation